Big health industry refers to all industries which takes health construction as the center and human health as the eventual aim. Both health food and functional food belong to the big health industry, yet there are differences between them. This article will make a comparison from five aspects based on their respective characteristics. Details are as follows:

1. Product Definition

Health food:

Health food refers to foods that claim to have specific health functions or supply vitamins and minerals. Health food is specific to certain groups. It can regulate body’s functions, but it cannot be usd for disease treating, and does not cause any acute, sub-acute or chronic harm to human body.

Functional food:

Actually, functional food is not a regulatory concept. There is no such food category in Chinese existing laws and regulations, so there is no official definition. It is more like a industry consensus. Generally, functional food in China refers to food with the functions of strengthening the body's defense function, regulating the physiological rhythm and promoting health. This kind of product can include health food, but it is broader than that.

At present, functional food, now standing at the forefront of the industry, mostly refers to common food with functional raw materials added. Therefore, for ease of understanding, the functional food mentioned below refers to such common food.

2. Product Overview

To enable readers to quickly understand the main differences between health food and functional food, CIRS Group has sorted out their key features, as shown in the table below.

Table 1. Analysis of main characteristics of health food and functional food products

|

Items |

Health food |

Functional food |

|

Essence |

Special food |

Common food |

|

Special identification |

(Health food "blue hat" logo) |

No identification |

|

Compliance requirements |

Registration or filing shall be completed according to relevant laws and regulations before listing |

The product formula and label comply with the corresponding laws and regulations, and no product registration or filing requirement. |

|

Available raw materials |

Health food for filing: raw materials listed in the Health Food Raw Materials Directory Health food for registration: common food raw materials, approved new food raw materials, "substances that are both food and traditional Chinese medicine", and other raw materials that can be used for health food stipulated by the government. |

Common food raw materials, approved new food raw materials, "materials that are both food and traditional Chinese medicine ", etc. |

|

Dosage form |

Most of them are tablet, hard capsule, soft capsule, oral lipid, granule, gummies, powder, etc. |

snack styles, such as beverage, candy, jelly, etc. |

|

Functional test |

Animal test and/or human feeding trail according to the declared health function are required for health food of registration type; No functional test is required for health food of filing type |

Functional tests are not required by regulations, and enterprises can independently choose whether to carry out relevant scientific research |

|

Daily intake limit |

Use amount with clear provisions |

Generally no limit |

|

Suitable groups |

There are specific suitable and unsuitable groups |

No specific applicable population generally |

|

Target users |

Most of them are middle-aged and elderly people, as well as those with specific needs |

Most of them are young people |

|

Advertising |

It shall comply with the provisions of the Advertising Law of China, and shall not use advertising spokespersons for recommendation or certification |

Must comply with the provisions of the Advertising Law of China, and can use advertising spokesmen to make recommendations |

3. Functional Claims

Health food:

As special food, health food shall have explicit health function claims. At present, China allows "24+1" health functions to be claimed by health food, including 24 health functions for functional health food (Table 2 below) and 1 health function for nutrient supplements (vitamin/mineral supplement)

Table 2. List of health functions

|

01 |

02 |

03 |

04 |

|

enhancing immune |

antioxidative |

assisting memory improvement |

alleviating eye fatigue |

|

05 |

06 |

07 |

08 |

|

clear the throat |

sleep improvement |

alleviating physical fatigue |

enhancing anoxia endurance |

|

09 |

10 |

11 |

12 |

|

assisting control of body fat |

increasing bone density |

improving iron deficiency anemia |

eliminating acne |

|

13 |

14 |

15 |

16 |

|

eliminating skin chloasma |

improving skin water content |

regulating gastrointestinal tract flora |

facilitating digestion |

|

17 |

18 |

19 |

20 |

|

facilitating feces excretion |

assisting the protection of gastric mucosa |

helping maintain healthy levels of blood lipids (cholesterol/triglycerides) |

helping maintain healthy blood sugar levels |

|

21 |

22 |

23 |

24 |

|

helping maintain healthy blood pressure |

assisting the protection against chemical injury of liver |

assisting irradiation hazard protection |

alleviating lead excretion |

Functional food:

As common food, functional food are not allowed to claim any health functions or imply to have health function by words, pictures or other means according to the Food Safety Law of the People's Republic of China and its implementing regulations, GB 7718-2011 and other existing regulations.

4. Development Status

Health food:

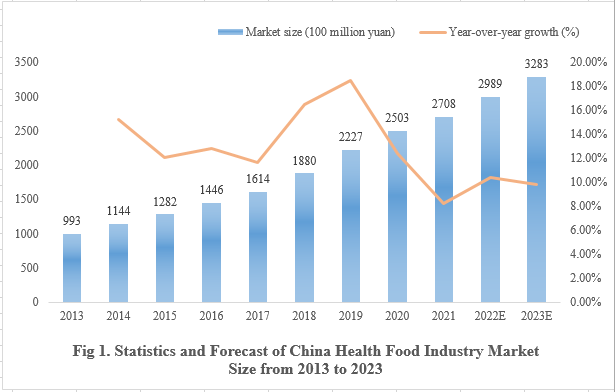

Health food in China originated from the 1980s. After decades of ups and downs, it now becomes more standardized. On the one hand, China has introduced a number of laws and policies to strictly supervise the registration and filing of health food, helping health food get rid of the "crisis of trust"; On the other hand, a series of factors, such as the aging of the population, the enhancement of national health awareness and the improvement of consumption level, have also promoted the development of the industry. As shown in Figure 1 below, the size of health food market in China reached 270.8 billion yuan in 2021, up by 20.5 billion yuan compared with 2020, with a year-on-year increase of 8.19%. Overall, the scale of China's health food market is growing rapidly. It is estimated that the size of health food market in China will reach 298.9 billion yuan by the end of 2022.

Data source: iMedia Consulting, Zhiyan Consulting

However, as the industry recovers, there are still come difficulties:

- Product homogenization: According to the annual health food data collation of CIRS Group, the products that have obtained the registration approval and filing certificate in recent years are mainly to enhance immunity and supplement vitamins and minerals. Besides, the products on the market are almost the same and lack certain innovation.

- Limitation in health function: At present, the claimed health function of health food is strictly limited and mainly targeted at middle-aged and elderly people. In the face of personalized and detailed needs of young consumers, the existing health function appears to be a little stretched.

Functional food:

Functional food has sprung up as a new force in the big health industry in recent years. The younger generations have become the main force of the health care. Their fashionable aesthetics and great purchasing power have attracted many capitals to focus on the functional food market. With the continuous improvement of the application and approval system of new food raw materials in China, more and more functional new food raw materials (such as sodium hyaluronate) are used in functional food, which has promoted the development of functional food industry in China.

Nevertheless, the industry still faces many sore points:

- High unit price: because of the addition of functional raw materials, the price of functional food is generally higher than that of other common food. The question of "is it worth paying for the efficacy" also follows.

- Somatosensory weakness: firstly, the rigid regulation that common food is not allowed to make function claims weakens the sense of efficacy of products in the psychology of consumers. Secondly, consumers will try a new product by purchasing ones at first, and only eat once will not have a strong sense of efficacy.

- Low repurchase: The functional food raceway is new and the majority of products are newly-established. The products are mainly developed and produced by OEM and ODM patterns, which result in endless products of the same type on the market. It is difficult for consumers to focus on one brand.

5. Industry Prospect

Health food:

At present, health food is developing in a standardized way under the dual track management mode. With the expansion of the dosage form and raw material catalogue of filing products, the market of health food has gradually expanded and its innovation has further improved. In the Internet era, the channels for consumers to buy health food are also changing, and online sales business has gradually become a new impetus for industry growth. In addition, consumers are also eager to purchase imported health food through cross-border e-commerce (CBEC). Compared with domestic products, imported products sold through CBEC have more choices in ingredients, functions, etc. It follows then that the future trend of health food market will be "product diversification", "younger users" and "channel e-commerce".

Functional food:

Benefiting from the popularity of the post-90s and post-00s generation, functional food has a promising future. In May this year, the China Food Industry Association, together with T-mall Food and other organizations, jointly released the "Six Commercial Hotspots of 2022 Food", which providing a good trend guidance for the functional food industry. For example, in terms of product research and development, enterprises should timely arrest the new requirements of user groups, roll out targeted products, accurately hit the pain points of the consumers, and seize market share. In terms of raw material selection, the popularity of plant based raw materials is high, and "plant energy" has attracted much attention. At the same time, the credibility of the product can be enhanced through the use of multiple raw materials with the same functionality and endorsed with the functional test report.

6. Epilogue

On August 2, 2022, SAMR issued the Implementation Rules for Technical Evaluation of New Functions of Health Food (Trial) (Draft for Comments), which is undoubtedly a good signal for health food. It means that in the future, the health function will no longer be constrained to the currently proposed 24 health functions. The health functions approved abroad and the health functions innovated and developed by enterprises will have the opportunity to be included in the health food function catalog. Moreover, the Implementation Rules also mentioned that the research samples of new functions of health food can be the marketed common food with new functions, which means that the development of functional food is expected to promote the innovation of health food in the future.

If you have any needs or questions, please contact us at service@hfoushi.com.